(File photo) A merchant trading in RMB at an open-air market. She holds in her hand 1 RMB in change. Photographed in Ryanggang Province in October 2013 (ASIAPRESS)

◆ Authorities intervene in the foreign exchange market

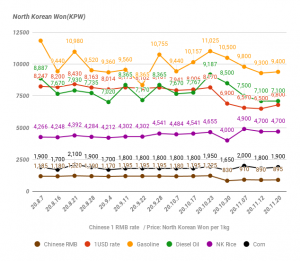

Since the end of April, North Korean authorities have been attempting to regulate exchange rates at markets. This began with a crackdown launched by the nation’s security agencies against the use of foreign currency by ordinary citizens. According to a local reporting partner, “[The crackdown is now] stricter than ever before. I can’t even take out Chinese banknotes at the market.” For this report, ASIAPRESS collected information from Pyongyang, adding to data gathered from market surveys conducted on May 4 in North Hamkyung Province and Ryanggang Province. (Kang Ji-won)

According to a reporting partner in Hyesan, Ryanggang Province, the market exchange rate for one US dollar was 8,050 North Korean won, as of May 4. However, exchange rates at banks have fallen now by about 11%, with the US dollar now valued at 7,200 North Korean won. Previously, it was possible to exchange foreign currency for North Korean won at banks. Though bank rates were typically a bit worse than the rates offered at markets, this gap has now widened significantly.

It is also said that the government’s efforts to make trading companies convert their RMB and US dollars to North Korean won has led to widespread anxiety among ordinary residents. As they do not trust the North Korean won, most citizens, including the poor, try to save a small amount of foreign currency. However, there are now concerns that foreign currency may become too difficult to use.

A reporting partner in Hyesan City said, “Although no official orders have been given at workplace and Party meetings outlining a ban on the use of foreign currency, there are rumors spreading in Pyongyang that the ‘use of foreign currency will be banned entirely in the future.’ Official foreign currency vendors and other commercial institutions are offering much worse exchange rates than the markets.”

Next page :Too afraid to use foreign currency at markets...